Santa Clara, California – On July 9, 2025, a company founded in a Denny’s booth three decades ago achieved what was once unthinkable: Nvidia Corporation (NVDA) became the first publicly traded company in history to reach a $4 trillion market valuation. This watershed moment – fueled by an insatiable global hunger for artificial intelligence – marks not just a financial milestone, but the coronation of Nvidia as the undisputed engine powering the Fourth Industrial Revolution. Shares surged 2.5% to an all-time high of $164.42 in early trading, cementing a staggering 74% rebound from April lows and a 22% year-to-date gain that dwarfed broader market indices.

Beyond Chips: The Architecture of an AI Empire

Nvidia’s ascent transcends semiconductor manufacturing. It represents a fundamental shift in how the world computes:

- The GPU Metamorphosis: Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia pioneered Graphics Processing Units (GPUs) for gaming. Its critical insight was recognizing that the parallel processing architecture of GPUs – initially designed to render complex game visuals – was uniquely suited for the massive, simultaneous calculations required by AI algorithms. This transformed the GPU from a niche component into the “CPU of AI.”

- Software is the Lock-In: Nvidia’s true genius lies in CUDA, its proprietary computing platform and API layer introduced in 2006. CUDA allows developers to harness the raw power of Nvidia GPUs for general-purpose processing (GPGPU), creating an immense, sticky software ecosystem. Building AI models on CUDA made switching hardware prohibitively difficult, creating an unparalleled “hardware-software moat.”

- AI’s “iPhone Moment”: The 2022 release of OpenAI’s ChatGPT, trained on a supercomputer powered by 10,000 Nvidia A100 GPUs, was Nvidia’s big bang moment. It irrefutably demonstrated that advanced AI required Nvidia’s computational density. Demand exploded overnight, turning its H100 and subsequent Blackwell GPUs into the most valuable commodities in tech.

Why $4 Trillion? Decoding Nvidia’s Market Dominance

Nvidia’s valuation isn’t hype; it’s underpinned by unprecedented financial performance and market control:

- Revenue Rocket Ship: Q1 FY2026 revenue hit $44.1 billion – a 69% YoY surge. Data Center revenue, driven by AI chip sales, was an astonishing $39.1 billion (73% YoY growth). For Q2, Nvidia guided revenue to $45 billion (±2%) – exceeding the annual GDP of many nations.

- Profit Powerhouse: Despite a $4.5 billion hit from US-China export controls, Nvidia reported Q1 profits near $19 billion. Its gross margins hover around a remarkable 75%, reflecting pricing power and efficient scale.

- Market Share Monopoly: Nvidia commands an estimated 80-90% share of the AI accelerator market for data centers. Competitors like AMD and Intel struggle to match its performance and, crucially, its mature CUDA software stack.

- The S&P 500 Anchor: Nvidia now carries the highest weighting (7.3%) in the S&P 500 index, surpassing Apple (7%) and Microsoft (6%). Its performance single-handedly influences broader market sentiment.

- Global Scale: Nvidia’s value exceeds the combined market cap of all publicly listed companies in the UK and is greater than the GDP of France or Britain.

| Company | 2023 Valuation | 2025 Valuation | Growth |

|---|---|---|---|

| Nvidia (NVDA) | $1.0T | $4.01T | +301% |

| Microsoft | $2.5T | $3.75T | +50% |

| Apple | $2.8T | $3.10T | +11% |

The Engine Room: Nvidia’s Technology Fueling the AI Fire

Nvidia’s dominance rests on continuous, blistering innovation:

- The Blackwell Architecture: Launched in 2024 and ramped to “massive-scale production” in 2025, Blackwell (e.g., GB200 GPUs) isn’t just faster. It’s architected for “Reasoning AI” – enabling AI systems to perform complex, multi-step tasks and long-chain reasoning critical for agentic AI (AI that acts autonomously). Huang calls this the “next scaling law” beyond training. (NVIDIA GTC Keynote)

- AI Factories & Omniverse: Nvidia envisions dedicated “AI Factories” – massive data centers built around its full stack (chips, networking, software). The $500 billion “Stargate Project” with Microsoft exemplifies this. Coupled with Omniverse, its platform for creating photorealistic digital twins of factories, cities, and even planets, Nvidia is building the infrastructure for real-world AI simulation and deployment.

- Software Ecosystem Expansion: Beyond CUDA, Nvidia is aggressively deploying NVIDIA NIM microservices and AI Blueprints – pre-built, optimized AI modules (like the Llama Nemotron family) allowing enterprises to deploy AI agents faster. This reduces barriers and deepens reliance on Nvidia’s ecosystem.

- Physical AI & Robotics: Nvidia is pushing AI beyond data centers into the physical world. Platforms like Jetson Orin Nano Super for edge devices and NVIDIA Cosmos for generative world models are accelerating the development of intelligent robots and autonomous systems.

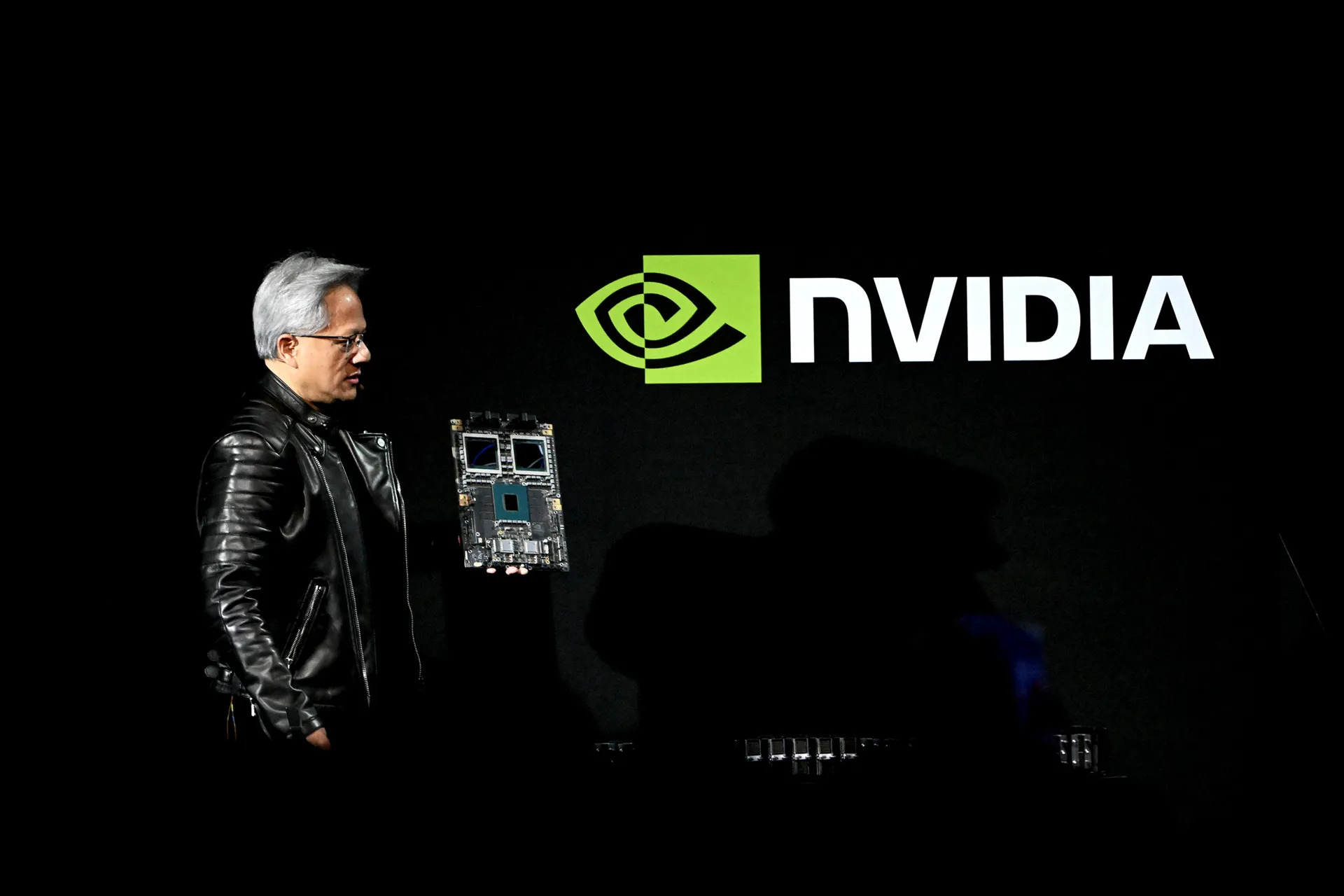

The Man Behind the Machine: Jensen Huang’s Visionary Leadership

Jensen Huang, the charismatic co-founder and CEO, is inseparable from Nvidia’s success. His journey – from a Denny’s busboy to the world’s 9th/10th richest person (net worth ~$140-$142 billion) – is legendary.

- Relentless Focus: Huang famously instilled a culture of operating like the company was “thirty days from going out of business,” fostering relentless innovation even during early near-bankruptcies.

- Strategic Foresight: Pivoting GPUs towards parallel computing (CUDA) and betting early on deep learning positioned Nvidia perfectly for the AI explosion. His 2023 proclamation that “accelerated computing and AI have fully arrived” proved prescient.

- Navigating Geopolitics: Huang actively lobbies against restrictive US chip export controls to China (costing ~$8B in lost Q2 sales), while simultaneously forging partnerships in Europe and the Middle East (e.g., Saudi Arabia’s Stargate) to diversify markets.

- The “Taylor Swift of Tech”: Huang’s iconic leather jacket, energetic keynotes (like March 2025’s GTC and June’s VivaTech), and direct communication style have made him a globally recognized tech icon, boosting Nvidia’s brand.

Headwinds and the Road to $5 Trillion

Despite its dominance, Nvidia faces significant challenges:

- Geopolitical Tightrope: US-China tech decoupling remains the biggest threat. Stringent export controls block a massive market ($50B+). While developing China-specific chips (H20), policy shifts can instantly disrupt revenue. Resolution depends heavily on ongoing US-China trade negotiations.

- The Competitive Frontier: While far behind, competitors are investing massively. AMD’s MI300X, Intel’s Gaudi 3, and custom silicon efforts by cloud giants (Google TPU, Amazon Trainium) aim to erode Nvidia’s share. Open-source software initiatives also seek to weaken CUDA’s lock-in.

- The DeepSeek Moment: Early 2025 saw panic when Chinese startup DeepSeek demonstrated powerful AI on supposedly less hardware. While Nvidia rebounded, it highlighted the market’s sensitivity to any sign its chips aren’t indispensable. Huang framed DeepSeek as validation, not threat.

- Sustainability and Scaling: Building and powering “AI Factories” consumes massive energy. Nvidia touts accelerated computing as “sustainable computing” – claiming its chips deliver far more compute per watt than CPUs – but scaling to meet demand while managing environmental impact is critical.

- Valuation Scrutiny: Trading at a forward P/E of ~32 (below its 3-yr avg of 37 but still high), some question sustainability. Bears argue any slowdown in AI spending or margin compression could spark a sharp correction.

Catalysts for the Next Trillion:

- AI Agent Breakthroughs: Widespread adoption of “Agentic AI” (AI that autonomously plans and executes tasks) requiring complex reasoning will demand exponentially more Nvidia’s Blackwell and future architectures (NVIDIA Technical Blog)

- Sovereign AI Boom: Nations racing to build domestic AI capacity (“Sovereign AI”) represent massive new markets. Europe, backed by Nvidia tech, is a key growth target.

- China Resolution: A trade deal easing restrictions could unlock billions in pent-up Chinese demand overnight.

- New Verticals: Automotive (self-driving), Healthcare (drug discovery), Robotics, and Industrial Digital Twins are still in early innings for Nvidia penetration.

- The 2026 Capex Cycle: Upcoming announcements from cloud giants (Microsoft Azure, AWS, Google Cloud) about 2026 data center spending will be a major signal. Expectations are for another record year.

Analysts like Loop Capital project a $6 trillion market cap by 2028, believing Nvidia’s monopoly on “critical tech” remains intact.

The Future is Accelerated: Nvidia’s Enduring Legacy

Nvidia’s $4 trillion valuation is more than a stock market anomaly; it’s a referendum on the centrality of AI to humanity’s future. The company has successfully transitioned from powering pixels to powering intelligence.

“We are at the beginning of [AI] transforming every industry, from the way we do software to health care and financial services to retail to transportation, manufacturing,” Huang declared on a recent earnings call. Nvidia isn’t just selling chips; it’s selling the foundational infrastructure for this transformation.

While challenges around geopolitics, competition, and sustainability loom large, Nvidia’s technological lead, software ecosystem, and visionary leadership position it uniquely. The era of accelerated computing, built on the backbone of Nvidia’s architecture, is just beginning. As the world races to deploy ever-more sophisticated AI, the journey from $4 trillion to $5 trillion may be shorter than many imagine.