This Tesla earnings report delivers a seismic reality check: a 12% year-over-year revenue plunge – the steepest quarterly decline since 2015. As an industry analyst reviewing automotive earnings for 15+ years, I’ve never seen Tesla face such converging headwinds. Political backlash from Musk’s government role, evaporating subsidies, and robotaxi execution risks create a perfect storm that threatens Tesla’s core business model.

Tesla Earnings Report Breakdown: Decoding the Q2 Financial Crisis

- Historic Revenue Collapse

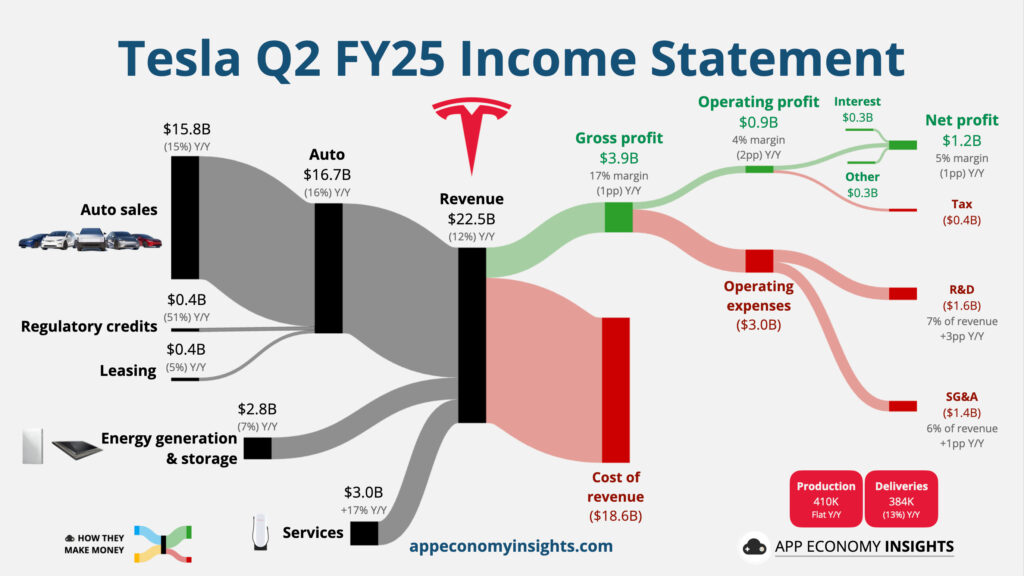

- $22.5B revenue (down 12% YoY) – worst decline in 10 years

- Automotive revenue implosion: 16.6% drop to $16.6B

- Missed Wall Street expectations despite lowered bar

- Profitability Freefall

- Operating income cratered 42% to $923M

- Regulatory credits now 47% of profits ($439M) – soon to vanish

- EPS of $0.40 matches revised estimates but down 23% YoY

- Cash Flow Crisis

- Delivery Disaster

- 384,122 vehicles delivered (14% decline)

- Revenue per vehicle: $42,231 ▼ $500

- Seventh consecutive quarterly drop in California registrations

The Perfect Storm: Why Tesla’s Engine Is Sputtering

1. Political Backlash and Brand Erosion

Elon Musk’s deep entanglement with the Trump administration has triggered measurable brand damage:

- As head of the “Department of Government Efficiency” (DOGE), Musk oversaw mass federal layoffs and elimination of agencies like USAID, sparking nationwide protests and boycott campaigns against Tesla.

- His endorsement of Germany’s far-right AfD party contributed to Tesla’s 40% sales collapse in the EU during June and a 33% year-to-date decline across European markets.

- “The Tesla brand is under attack and provides a prime example of negative brand equity rub,” noted Forrester analyst Dipanjan Chatterjee. “The perception of Elon Musk has rubbed the sheen right out of what once was a darling and soaring automotive brand.”

2. Subsidy Sunset and Regulatory Credit Cliff

Two critical revenue streams face imminent evaporation:

- The federal $7,500 EV tax credit expires September 30th under Trump’s “One Big Beautiful Bill.” CFO Vaibhav Taneja warned this creates a “pull forward” demand effect, leaving Tesla with “limited supply” to guarantee U.S. deliveries in late August and beyond.

- Revenue from regulatory credit sales—long a profit prop—plunged to $439 million from $890 million a year ago. The new legislation eliminates emissions penalties for rivals, effectively destroying this $11 billion revenue stream that sustained Tesla through lean periods.

3. Competitive Onslaught and Product Gap

- Chinese rivals like BYD now offer affordable EVs with advanced features as standard, threatening Tesla’s global leadership position. BYD is poised to surpass Tesla as the world’s largest EV maker without even selling in the U.S.

- Tesla’s delayed “Model 2” leaves a gaping hole in the affordable EV segment. The company confirmed “first builds of a more affordable model” began in June, but analysts indicate this is likely a stripped-down Model Y rather than a revolutionary new platform.

“Tesla’s European sales down a third in 2025… Tesla’s European sales have slumped 33% during the year so far to 110,000 compared with 165,000 in the first half of 2024″ – The Guardian

Musk’s Gambit: Betting the Company on Autonomy

Facing automotive headwinds, Musk aggressively pivoted the narrative toward Tesla’s futuristic endeavors during the earnings call:

- Robotaxi Reality Check: After years of delays, Tesla launched a limited robotaxi service in Austin last month—but with significant caveats. Operating in a tiny geo-fenced area with “safety drivers” in passenger seats, the service remains invitation-only for Tesla enthusiasts. Videos quickly surfaced of vehicles driving in wrong lanes, speeding, and struggling with left turns, triggering an NHTSA investigation.

- Ambitious Expansion Claims: Musk projected robotaxi availability to “half the U.S. population by end of this year” and suggested owners could add their vehicles to the Tesla fleet “next year.” These claims appear optimistic given Tesla hasn’t secured permits in key markets like California and lags Waymo, which already offers 250,000 paid weekly rides across multiple cities.

- Optimus Overpromises?: Musk claimed Tesla’s humanoid robot now “freely walks around” Palo Alto labs and set a target to produce 1 million units within five years. Yet with no commercial prototypes or defined use cases, analysts question the timeline.

The Road Ahead: Survival Strategies and Existential Questions

Near-Term Mitigation Efforts

- Fire Sale Mode: Tesla has unleashed significant discounts and financing deals across its lineup to clear inventory before the tax credit expiration.

- Supply Chain Shifts: Taneja acknowledged Tesla is “shift[ing] aspects of its supply chain” to navigate Trump’s tariffs, though this caused abrupt U.S. vehicle shortages.

- Leadership Exodus: High-profile executives, including Musk’s longtime confidant overseeing North American and European sales/manufacturing, exited in Q2—raising execution concerns.

Long-Term Strategic Questions

- Affordable EV or Autonomy?: Tesla’s shareholder letter mentioned “volume production planned for the second half of 2025” on its affordable model. But Musk’s conference call emphasis remained squarely on autonomy: “Autonomy is the story. It amplifies value to stratospheric levels.” This duality leaves investors questioning where capital allocation will focus.

- Political Liability: Musk’s launch of the “America Party” after his DOGE role and feud with Trump creates ongoing brand toxicity. His admission that he wants “enough control [of Tesla] to ensure it goes in a good direction, but not so much that I can’t be thrown out if I go crazy” underscores governance risks.

- Cash Burn Concerns: With massive R&D spending on robotaxis, Optimus, and AI, Tesla’s dwindling cash reserves raise alarms. Morgan Stanley calls Tesla a “top pick” for its AI potential, while JPMorgan warns its stock is “completely divorced from increasingly deteriorating fundamentals.”

“We probably could have a few rough quarters. I am not saying that we will, but we could” – Elon Musk, Tesla Q2 2025 Earnings Call

Regional Realities: A Global Market in Flux

- Europe’s EV Winter: Tesla’s European nightmare deepened with a 40% sales plunge in June and 44% year-to-date decline in the EU. Even the refreshed Model Y couldn’t reverse the slide attributed to Musk’s AfD endorsement and Trump association.

- California Cool-Down: Registrations fell for the seventh straight quarter, dropping 21.1% in Q2. Once Tesla’s fortress market, the state now reflects broader U.S. softening.

- China’s Conundrum: While Tesla didn’t detail China results, BYD’s ascendancy highlights Tesla’s vulnerability in the world’s largest EV market, especially without a true budget offering.

The “Weird Transition” Toward an Uncertain Future

Tesla’s Q2 earnings reveal a company navigating what Musk himself called a “weird transition period.” The evaporation of regulatory credits and tax incentives, combined with Musk’s political baggage, creates near-term turbulence even as the company chases an autonomous future. With its affordable EV delayed and robotaxis still in infancy, Tesla faces a precarious 12-18 months.

Analysts remain polarized. Wedbush’s Dan Ives sees a “positive crossroads” with Musk “laser focused” and autonomy expanding. Yet for ordinary investors, the path forward hinges on unanswered questions: Can Tesla actually deliver autonomy at scale? Will the stripped-down Model Y move the needle? And can the brand outrun Musk’s political controversies?

One truth emerges clearly: Tesla’s era of easy growth is over. The company that once defined the EV revolution must now prove it can navigate a world where political alignment matters as much as battery range, where cash flow trumps vision, and where “rough quarters” might be the price of reaching that “compelling” future Musk envisions in late 2026.